work from home equipment tax deduction

You dont have to be a homeowner to claim the deduction apartments are eligible as are mobile homes boats or other similar properties according to the IRS. If youre a freelancer a small business owner or otherwise self-employed you can likely deduct.

Working From Home How To Claim Your Home Office Tax Deductions

Section 179 caps deductions at one million dollars and spending on equipment purchases at 25 million.

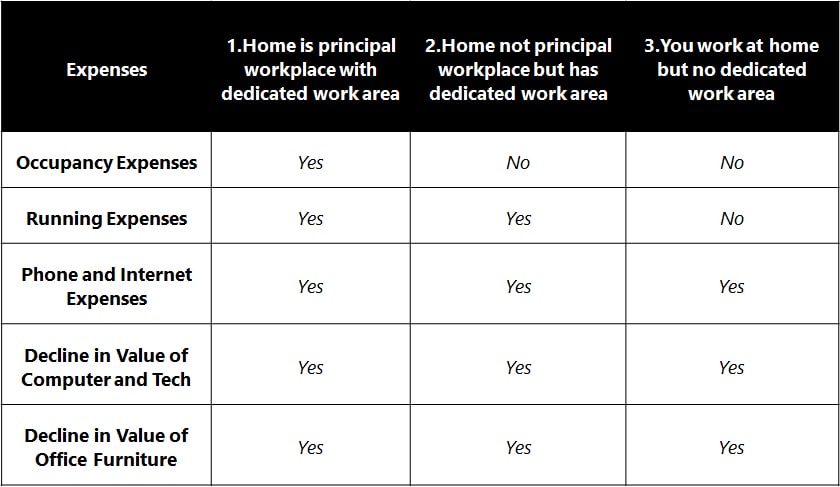

. Council and water rates 4259. How much you can claim. Expenses for working from home are not deductible for most employees since the 2017 tax reform law.

For example a company that purchases a new printer for 500 has the option of either. Abdul calculates his deduction for occupancy expenses as follows. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

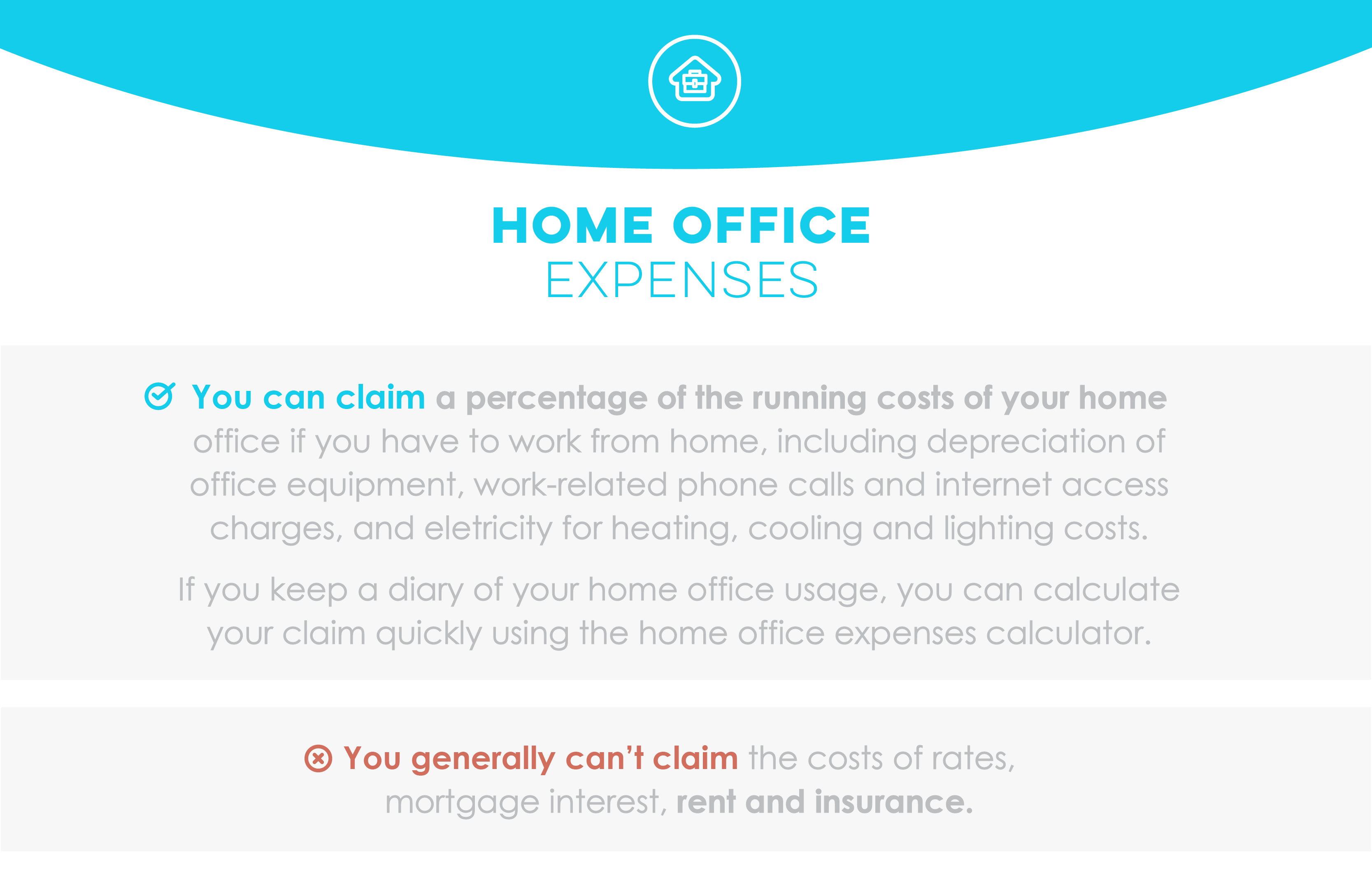

You can either claim tax relief on. Senior CitizenDisabled PersonsSurviving Spouse - An annual 250 deduction from property taxes is provided for the dwelling of a qualified senior citizen disabled person or their surviving. You can write off up to 100 of some expenses for your home office such as the cost of repairs to the space.

The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. Tax deduction for home office expenses is only allowed if the room is regularly and exclusively used for the. Samsung voice input supported languages southern charm season 8 episode 5 youtube tv.

The expense must directly relate to earning your income. You can also deduct a portion of other expenses including. You must have spent the money.

And one thing to remember is now as a result of tax reform you can only claim home expenses if youre self. There are two methods for claiming the deduction. You are eligible for a property tax deduction or a property tax credit only if.

6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra. The home office deduction allows certain people who use part of their home for work to deduct some housing expenses. A few very specific types of W-2.

Total occupancy expenses floor. For people filing for tax years before 2018 work from home deductions. Yes thats a big question were hearing.

IRS Tax Tip 2020-98 August 6 2020. With more people working from. The IRS used to allow W-2 employees to deduct expenses related to working from home but Congress changed that with its 2017 tax reform bill.

Before the Tax Cuts and Jobs Act of 2018 made sweeping changes to the federal tax code employees who worked from a home office could claim the deduction. In tax year 2013 the IRS introduced a simplified option to calculate the deduction for home offices as opposed to their more in-depth regular method. As an employee to claim a deduction for working from home all the following must apply.

What are the requirements for claiming home office expenses. To understand more about how you can claim tax deductions when working from home take a look at the following tax tips for employees. It depends on whether youre working for yourself or for an employer.

Working From Home All You Need To Know To Claim Your Maximum Deduction Cocomo Advisory

Does Working From Home Have Any Tax Savings Via The Home Office Deduction

8 Tax Deductions You May Be Able To Claim At Tax Time

Tax Deductions When Working From Home Everything To Know Fox Business

The Top 5 Forgotten Tax Deductions Don T Miss These On Your Return

Home Office Tax Deduction Prerequisites And Tips Ionos

Home Office Expenses Are You Missing Out On Valuable Tax Deductions

What Is Remote Work Allowance A Guide To Tax Deductions Relief

Quick Guide Tax Deductions For Work From Home Expenses Paul Wan Co

2020 Income Tax What You Can T And Can Claim For Your Work From Home Office During The Covid 19 Pandemic Moneysense

Top 12 Forgotten Ato Real Estate Tax Deductions Propertyme

Working From Home Tax Deductions Covid

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Are Home Improvements Tax Deductible Dumpsters Com

Tax Deductible Home Improvements For 2022 Budget Dumpster

What Is A Remote Work Stipend And Why Do You Need One

How To Claim Your Work Related Car Expenses In 2020 Gofar

Sales And Marketing Workers Tax Return And Deduction Guide

Tax Deductions For Home Office Expenditure Working From Home